In finance, the Beta (β) of a stock or portfolio is a number describing the relation of its returns with those of the financial market as a whole.

An asset has a Beta of zero if its returns change independently of changes in the market’s returns. A positive beta means that the asset’s returns generally follow the market’s returns, in the sense that they both tend to be above their respective averages together, or both tend to be below their respective averages together. A negative beta means that the asset’s returns generally move opposite the market’s returns: one will tend to be above its average when the other is below its average.

The beta coefficient is a key parameter in the capital asset pricing model (CAPM). It measures the part of the asset’s statistical variance that cannot be removed by the diversification provided by the portfolio of many risky assets, because of the correlation of its returns with the returns of the other assets that are in the portfolio. Beta can be estimated for individual companies using regression analysis against a stock market index.

Definition

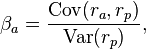

The formula for the beta of an asset within a portfolio is

where ra measures the rate of return of the asset, rp measures the rate of return of the portfolio, and cov(ra,rp) is the covariance between the rates of return. The portfolio of interest in the CAPM formulation is the market portfolio that contains all risky assets, and so the rp terms in the formula are replaced by rm, the rate of return of the market.

Beta is also referred to as financial elasticity or correlated relative volatility, and can be referred to as a measure of the sensitivity of the asset’s returns to market returns, its non-diversifiable risk, its systematic risk, or market risk. On an individual asset level, measuring beta can give clues to volatility and liquidity in the marketplace. In fund management, measuring beta is thought to separate a manager’s skill from his or her willingness to take risk.

The beta coefficient was born out of linear regression analysis. It is linked to a regression analysis of the returns of a portfolio (such as a stock index) (x-axis) in a specific period versus the returns of an individual asset (y-axis) in a specific year. The regression line is then called the Security characteristic Line (SCL).

αa is called the asset’s alpha and βa is called the asset’s beta coefficient. Both coefficients have an important role in Modern portfolio theory.

For an example, in a year where the broad market or benchmark index returns 25% above the risk free rate, suppose two managers gain 50% above the risk free rate. Because this higher return is theoretically possible merely by taking a leveraged position in the broad market to double the beta so it is exactly 2.0, we would expect a skilled portfolio manager to have built the outperforming portfolio with a beta somewhat less than 2, such that the excess return not explained by the beta is positive. If one of the managers’ portfolios has an average beta of 3.0, and the other’s has a beta of only 1.5, then the CAPM simply states that the extra return of the first manager is not sufficient to compensate us for that manager’s risk, whereas the second manager has done more than expected given the risk. Whether investors can expect the second manager to duplicate that performance in future periods is of course a different question.

Security market line

The Security Market Line |

The SML graphs the results from the capital asset pricing model (CAPM) formula. The x-axis represents the risk (beta), and the y-axis represents the expected return. The market risk premium is determined from the slope of the SML.

The relationship between β and required return is plotted on the security market line (SML) which shows expected return as a function of β. The intercept is the nominal risk-free rate available for the market, while the slope is E(Rm)− Rf. The security market line can be regarded as representing a single-factor model of the asset price, where Beta is exposure to changes in value of the Market. The equation of the SML is thus:

It is a useful tool in determining if an asset being considered for a portfolio offers a reasonable expected return for risk. Individual securities are plotted on the SML graph. If the security’s risk versus expected return is plotted above the SML, it is undervalued because the investor can expect a greater return for the inherent risk. A security plotted below the SML is overvalued because the investor would be accepting a lower return for the amount of risk assumed.

Beta, volatility and correlation

A misconception about beta is that it measures the volatility of a security relative to the volatility of the market. If this were true, then a security with a beta of 1 would have the same volatility of returns as the volatility of market returns. In fact, this is not the case, because beta also incorporates the correlation of returns between the security and the market. By the definition of beta, the formula relating beta (β), the relative volatility of the security (σ), the correlation of returns (ρ) and the market volatility (σm) is

For example, if one stock has low volatility and high correlation, and the other stock has low correlation and high volatility, beta can compare their correlated volatility.

This also leads to an inequality (because |rho| is not greater than one):

In other words, beta sets a floor on volatility. For example, if market volatility is 10%, any stock (or fund) with a beta of 1 must have volatility of at least 10%.

Another way of distinguishing between beta and correlation is to think about direction and magnitude. If the market is always up 10% and a stock is always up 20%, the correlation is one (correlation measures direction, not magnitude). However, beta takes into account both direction and magnitude, so in the same example the beta would be 2 (the stock is up twice as much as the market).

Investing

By definition, the market itself has a beta of 1.0, and individual stocks are ranked according to how much they deviate from the macro market (for simplicity purposes, the S&P 500 is sometimes used as a proxy for the market as a whole). A stock whose returns vary more than the market’s returns over time can have a beta whose absolute value is greater than 1.0 (whether it is, in fact, greater than 1.0 will depend on the correlation of the stock’s returns and the market’s returns). A stock whose returns vary less than the market’s returns has a beta with an absolute value less than 1.0.

A stock with a beta of 2 has returns that change, on average, by twice the magnitude of the overall market’s returns; when the market’s return falls or rises by 3%, the stock’s return will fall or rise (respectively) by 6% on average. (However, because beta also depends on the correlation of returns, there can be considerable variance about that average; the higher the correlation, the less variance; the lower the correlation, the higher the variance.) Beta can also be negative, meaning the stock’s returns tend to move in the opposite direction of the market’s returns. A stock with a beta of -3 would see its return decline 9% (on average) when the market’s return goes up 3%, and would see its return climb 9% (on average) if the market’s return falls by 3%.

Higher-beta stocks tend to be more volatile and therefore riskier, but provide the potential for higher returns. Lower-beta stocks pose less risk but generally offer lower returns. Some have challenged this idea, claiming that the data show little relation between beta and potential reward, or even that lower-beta stocks are both less risky and more profitable (contradicting CAPM). In the same way a stock’s beta shows its relation to market shifts, it is also an indicator for required returns on investment (ROI). Given a risk-free rate of 2%, for example, if the market (with a beta of 1) has an expected return of 8%, a stock with a beta of 1.5 should return 11% (= 2% + 1.5(8% – 2%)).

Academic theory

Academic theory claims that higher-risk investments should have higher returns over the long-term. Wall Street has a saying that "higher return requires higher risk", not that a risky investment will automatically do better. Some things may just be poor investments (e.g., playing roulette). Further, highly rational investors should consider correlated volatility (beta) instead of simple volatility (sigma). Theoretically, a negative beta equity is possible; for example, an inverse ETF should have negative beta to the relevant index. Also, a short position should have opposite beta.

This expected return on equity, or equivalently, a firm’s cost of equity, can be estimated using the Capital Asset Pricing Model (CAPM). According to the model, the expected return on equity is a function of a firm’s equity beta (βE) which, in turn, is a function of both leverage and asset risk (βA):

- KE = RF + βE(RM − RF)

where:

- KE = firm’s cost of equity

- RF = risk-free rate (the rate of return on a "risk free investment"; e.g., U.S. Treasury Bonds)

- RM = return on the market portfolio

![beta_E = beta =left[ beta_A - beta_D left(frac {D}{V}right) right] frac {V}{E}](http://upload.wikimedia.org/math/8/8/6/886efee7ec7edade19175a572534f9a7.png)

because:

and

- Firm Value (V) = Debt Value (D) + Equity Value (E)

An indication of the systematic riskiness attaching to the returns on ordinary shares. It equates to the asset Beta for an ungeared firm, or is adjusted upwards to reflect the extra riskiness of shares in a geared firm., i.e. the Geared Beta.